Myth-busting super

Death and taxes are never pleasant topics to think about, but a little careful consideration now could save the people who will inherit your superannuation savings a big tax bill.

Many people assume there’s no tax payable on super death benefits, and in some circumstances this will be the case. But tax may be payable at varying rates depending on who receives the death benefit and in what form it’s received.

Careful planning of who gets the various parts of your estate can potentially save thousands of dollars in unnecessary tax.

Super and your Will

The total amount of super death benefit paid out to your beneficiaries will include money left in your super account at the time of your death plus the value of any life insurance you held inside super.

Although super death benefits are distributed to your beneficiaries when you die, they do not form part of your estate and are not covered by your Will – unlike other assets such as your home.

The trustee of your super fund decides who receives your death benefit and although your Will may be used as a guide, the trustee is not bound by it.

To help ensure the trustee pays your death benefit to the right person, you need to nominate your preferred beneficiaries. If your fund allows it, consider making a binding nomination as this instructs and binds the fund trustee to pay your death benefit to a specific person or, alternatively, to the executor of your estate. Death benefits left to your executor can then be distributed as set out in your Will. Binding nominations need to be renewed every three years to remain valid.

Tax and super death benefits

Just to complicate matters, the definition of a dependent is slightly different under super law and tax law. Under super law, a dependent can be a spouse (including de facto and same sex partners), a child of any age or a person who was financially dependent on the deceased. Under tax law, adult children over 18 are not considered dependents unless they were in an interdependency relationship with the deceased at the time of death.

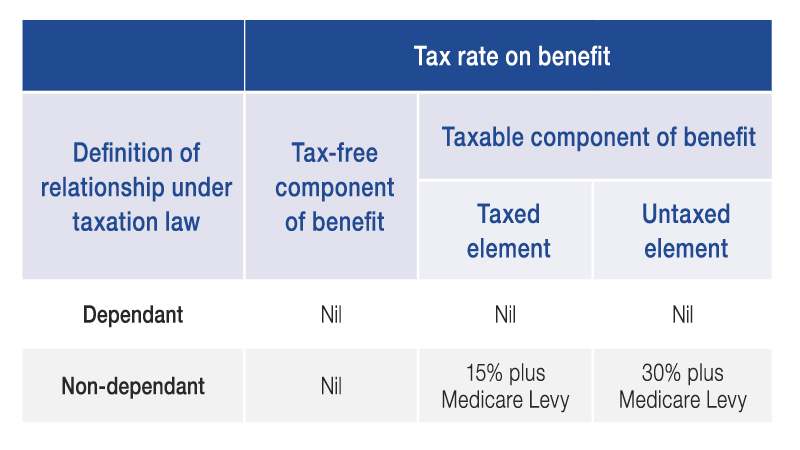

As a general rule of thumb, super death benefits paid to dependants under tax law are tax freei, but death benefits paid to non-dependants such as adult children are taxed and can only be received as a lump sum.

Factors such as whether the components of the benefit are tax-free or taxable, the age of the member at the time of their death, and whether the benefit is paid as a lump sum or as an income stream also affect how the benefit is taxed.

Special rules apply if a death benefit is paid to the executor of a deceased estate.

Lump sum or income stream?

Super fund members can instruct the trustee to pay an income stream to their dependants, but the tax imposed will vary with the age of the deceased and the recipient. Generally, the tax exempt component of the income stream is tax free, but the untaxed element is taxed at the recipient’s marginal tax rate less a tax offset. The exception is if both the deceased and recipient are aged under 60.

If the super death benefit is paid as an income stream to a child, pension payments must cease at age 25 (unless they are permanently disabled), with the remainder paid as a lump sum.

Taxation treatment of super death benefit paid as a lump sum

Note: The taxation rate applying to income stream benefits paid to dependants and non-dependants is different.

Existing pension payments

Normally a pre-existing super pension stops when the member receiving it dies, but if the super fund’s rules permit it, a ‘reversionary pension’ may be redirected to a dependant, usually the spouse.

The tax rate imposed on these reversionary pensions depends on the age of the deceased and the recipient.

Impact of July 2017 reforms

The upcoming changes to the super system will also affect the payment of super death benefits. Currently, some super funds (including SMSFs) have the option to increase a death benefit by making an anti-detriment payment.ii

These lump sum benefits act as a refund for the 15 per cent contributions tax paid by a super fund member during their lifetime. Anti detriment payments are paid to an eligible dependant who was a spouse or former spouse, a child (including an adult child), or trustee of the deceased’s estate.

From 1 July 2017, the use of anti-detriment payments will be scrapped as part of the government’s reforms to the super system.

The treatment of super death benefits is complex and often causes confusion. If you want your beneficiaries to receive their inheritance in the most tax effective manner, then you need to give careful thought to your overall estate plan well in advance. For example, you may decide to leave super death benefits to your spouse and non-super assets to your adult children or grandchildren.

If you would like to discuss the tax implications of your super death benefits, call our office today.

i www.ato.gov.au/individuals/super/super-and-tax/tax-on-benefits/

ii www.ato.gov.au/super/apra-regulated-funds/paying-benefits/paying-superannuation-death-benefits/

As always, if you would like to discuss the contents of this newsletter please give us a call 07 5559 5760.

Hugh Robertson

Hugh Robertson